Understanding the foreclosure process in LA is an important part of navigating your own home foreclosure.

Before we dive in…

What is foreclosure anyway?

Foreclosure is the legal process that lenders use to take back property that has a loan, typically after the borrower stops making payments.

Foreclosure is not fun, but know that it’s not the end of the world.

Understanding how foreclosure works in LA equips you with the knowledge you need in order to navigate it well and come out the other end as well as possible.

The Basic Stages of A Foreclosure

In any foreclosure, there are several stages that are significant to the process.

Foreclosure works in various ways in different states around the country.

To foreclose upon a property, different states use one of these two ways: judicial sale or power of sale.

While Louisiana is a Judicial State, we cover both ways here. You will read many things about the foreclosure process. Understanding a bit about both methods will help you decipher who’s giving you the best information. Remember, though, TIME IS NOT YOUR FRIEND. The clock is ticking. The sooner you involve someone working in your interest the further you will be from the dangers of foreclosure.

Connect with us by calling (504)500-5608 or through our contact page to have us go through the foreclosure process that is specifically for here in New Orleans.

In either case, foreclosure usually doesn’t go to court until 3-6 months of payments are missed. Typically (but not always), a lender will send numerous notices that you are overdue or behind in your payments.

Under Judicial Foreclosure:

- Your mortgage lender must file suit in the court system.

- You’ll receive a letter from the court demanding payment.

- If the loan is valid, you’ll have 30 days to bring payment to court to avoid foreclosure (sometimes that can be extended).

- If you don’t pay during the payment period, a judgment will be entered and the lender can request the sale of your property – typically by way of auction.

- When the property is sold, the sheriff serves an eviction notice and forces you to vacate the property immediately.

Under Power of Sale (or Non Judicial Foreclosure):

- The mortgage lender serves you papers demanding payment, and the courts are not essential – although the process might be subject to judicial review.

- After the set waiting period has passed, a deed of trust is written up and the control of your property is given to a trustee.

- Then, the trustee can sell your property for the lender by way of public auction (they must give notice).

During either type of foreclosure, any individual who has an interest in the property must be notified.

For example, any contractors or banks with liens against a foreclosed property are authorized to collect from auction proceedings.

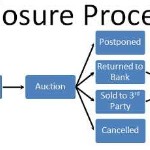

What Happens After A Foreclosure Auction?

After a foreclosure is completed, the loan amount is paid off with proceeds from the sale.

If the sale proceeds from the auction isn’t enough to cover the loan, sometimes a deficiency judgment can be issued against the borrower.

A deficiency judgment is where the bank gets a judgment against you, the borrower, for the remaining funds owed to the bank after the foreclosure sale.

Some states allow the loan amount to be weighed against the borrower in full, while other states put a limit on the amount owed in a deficiency judgment according to the value of the property when it was sold.

Because every state is different, here’s a great resource that lays out the state by state deficiency judgement laws.

It’s usually better to avoid a foreclosure auction. Instead, call the bank, or work with a reliable real estate firm like us at US Direct Home Buyers.

Experienced investors like us can help by negotiating directly with banks to lower the amount you owe in a sale – or remove it, regardless if your home is worth less than you owe.

If you need to sell a property near New Orleans, we can help.

We buy houses in New Orleans LA like yours from people who need to sell quickly.

Give us a call anytime (504)500-5608 or fill out the form on this website today! >>

Other Foreclosure Resources For New Orleans LA HomeOwners:

HTG-SCP01f-MGM

Video Transcript:

So a couple of things.

Let me just define quickly what a foreclosure is. A foreclosure is, where the mortgage company has posted the House for sale, and they’re going to sell it on a specific date. And the minute that sale occurs, it stops being your house. Or whoever’s house is being foreclosed on. It’s the same with property taxes. They’re going to post it for a certain date and the minute that sale occurs, whether it’s 10:02 on Tuesday or whatever, that property stops being yours, and starts belonging to someone else.

If that happens to you, then what will happen? Often times the sheriff or the trustee will come to your house sometimes from the sale, they’ll hand you a vacate notice. It could be a three day vacate notice or it might be longer. But they mean business when it gets to that point. So our goal is to avoid that from happening.

So that’s the point of this conversation. So remember it’s just really time-sensitive. If you’ve got a certified letter from either the taxing authority or the mortgage company, the clock has started and sometimes you can solve this if you have equity in the house, you can solve it. You, you really don’t want the foreclosure to be on your credit record if you can avoid it. That kind of sticks with you for a while. Then there’s a thing called forgiveness of debt. The IRS could look at that and say, “you owe us the money. ” “You owe us the money that we forgave. They treat that as income.”

So we want to be really careful not to get into that trap. So we got the basic definition for closure and, and why the time is so important, DON’T mess around with the time because even when people are trying to solve problems and really trying to help you, it could still take longer than what you expect. There are some things we can do to slow the process down or stop it. Some other things.

These are some of the options we want to talk about.